- What Is Generative AI in Banking?

- How Generative AI Works in Banking

- Benefits and Impact of Generative AI for Banks

- Seven Key Applications of Generative AI in Banking

- 1. AI-powered customer service and conversational banking

- 2. Real-time fraud detection and prevention

- 3. Intelligent loan processing and credit scoring

- 4. Compliance automation and regulatory reporting

- 5. Personalized financial recommendations and wealth management

- 6. Anti-Money Laundering (AML) and Know Your Customer (KYC) automation

- 7. Document processing and report generation

- Understanding the Technology Stack Behind Banking Generative AI Technology

- Common Challenges in Generative AI Banking Implementation and How to Address Them

- Challenge 1: Data quality and fragmentation

- Challenge 2: Legacy system integration complexity

- Challenge 3: Regulatory compliance and explainability

- Challenge 4: Data security and privacy risks

- Challenge 5: Model bias and fairness

- Challenge 6: Change management and adoption barriers

- Challenge 7: ROI measurement and implementation costs

- Steps to Successfully Implement Generative AI in Banking

- Step 1: Define your use case and establish baselines

- Step 2: Build your team and assess infrastructure

- Step 3: Design your solution architecture

- Step 4: Launch a pilot program (parallel to current systems)

- Step 5: Scale gradually across your organization

- Step 6: Establish continuous governance and monitoring

- Partner with Space-O AI to Build Secure and Scalable Gen AI Systems for Banking

- Frequently Asked Questions About Generative AI in Banking

- How much does generative AI implementation cost for banking institutions?

- How long does generative AI implementation take?

- How quickly can we see ROI from generative AI implementation?

- How do we handle AI bias in credit decisions?

- How does generative AI handle customer data privacy?

- Can generative AI replace human banking staff?

Generative AI in Banking: Use Cases, Benefits, Challenges, and Implementation Guide

Generative AI is quickly becoming one of the most transformative technologies in the banking industry. With the ability to understand context, analyze large volumes of data, and generate human-like responses or content, it is opening new possibilities for automation, personalization, and decision support across financial institutions.

A recent survey by the American Bankers Association of more than 400 banks found that 11 percent of financial institutions have already implemented generative AI, while another 43 percent are actively deploying it. This shows a clear shift toward early adoption and signals how urgently banks are moving to integrate AI into their operations.

As customer expectations rise and banks face growing pressure to reduce operational costs, improve compliance, and compete with digital-first players, generative AI offers a powerful way to modernize core workflows. Banks are already using it to simplify customer service, accelerate loan processing, detect fraud faster, and enhance employee productivity.

At the same time, leaders are exploring how it can support advisory services, streamline regulatory reporting, and improve internal knowledge management. While you can simply partner with a generative AI development agency to build your banking AI solution, knowing the basics is important to ensure GenAI’s optimal utilization in your banking institution.

This blog explores everything you need to know about generative AI in banking, including key use cases, benefits, challenges, real examples, and practical steps to implement it responsibly. If your team is evaluating how generative AI can fit into your digital transformation strategy, this guide will help you understand what is possible today and where the technology is headed next.

What Is Generative AI in Banking?

Generative AI in banking refers to the use of advanced AI models that can understand information, learn patterns from data, and generate new content or insights that resemble human output. These models can create text, summarize documents, analyze customer queries, produce recommendations, and support decision-making in ways that traditional rule-based systems cannot.

At the core of generative AI are large language models and transformer-based architectures that can process unstructured data such as emails, conversations, financial documents, policy texts, and customer profiles. Instead of simply identifying patterns, these models can generate meaningful responses, explanations, and predictions based on the context they receive.

Banks use generative AI to automate customer service, accelerate loan underwriting, improve fraud investigations, and support compliance teams with faster document analysis. It is becoming especially valuable as financial institutions manage rising data volumes and increasing demand for real time assistance.

How Generative AI Works in Banking

Generative AI in financial services is transforming banking through improved customer service, enhanced risk management, and increased operational efficiency. It learns patterns from your historical data, then generates insights, recommendations, and actions. It’s not just searching your database, it’s understanding it. Strategic generative AI model development ensures these capabilities are tailored to your institution’s unique data structures, compliance requirements, and business objectives.

Step 1: Data Collection and Connection

Most banks operate with fragmented data. Your customer information lives in one system, transaction history in another, compliance records in a third. This fragmentation is the real problem, not a lack of data.

Generative AI solves this by creating unified data pipelines. Instead of data sitting in silos, it flows through a connected infrastructure that makes all information accessible to intelligent systems in real-time. Your bank collects massive data daily:

- Customer transactions (every purchase, transfer, withdrawal)

- Market signals (interest rate changes, economic indicators)

- Regulatory filings (compliance documents, policy updates)

- Document archives (contracts, policies, historical records)

This unified data becomes the foundation for intelligent decision-making.

Step 2: Real-Time Analysis and Decisions

The moment data enters the system, the AI analyzes it against patterns learned from thousands of similar situations. Unlike batch processing that happens overnight, this happens instantly, enabling your bank to make time-critical decisions immediately rather than waiting for manual review.

The system doesn’t just identify patterns. It understands context, weighs multiple factors, and generates recommendations based on complete information. Real-time analysis triggers immediate decisions:

- Approve the loan (or flag for review)

- Flag suspicious transactions

- Generate compliance reports automatically

- Route customers to the right department

This all happens in seconds, not hours.

Step 3: Context-Aware Responses

Here’s where the transformation happens. Traditional systems detect problems. Generative AI in banking explains problems and suggests solutions. This shift from detection to explanation changes everything about how your teams work.

When your fraud analyst receives an alert from traditional AI, they spend hours investigating. When they receive an alert from our system, the investigation is already done, complete with reasoning, supporting data, and documentation.

Example 1: Customer ServiceWhen a customer asks, “Why was I charged this fee?”

Your old chatbot: Searches keywords, returns generic FAQModern system: Retrieves the customer’s account data, understands the specific context, analyzes similar situations, and generates a personalized explanation in seconds

Result: Human-like conversation. Accurate information and problems solved faster.

Example 2: Fraud DetectionWhen a suspicious transaction arrives:

Traditional systems: Flag it and send an alertModern system: Analyzes why it’s suspicious, pulls supporting data (geographic anomalies, amount patterns, watchlist hits), and generates a complete Suspicious Activity Report with detailed reasoning

Result: Compliance-ready documentation. Faster review process. Better decision-making by your team.

Institutions building these context-aware systems often invest in professional generative AI consulting services. This ensures the system delivers accurate, context-aware responses built with the expertise of teams who understand both banking workflows and modern AI capabilities.

Build Intelligent AI Systems That Solve Real Banking Problems

AOur 80+ certified AI specialists combine technical expertise with banking knowledge to design, build, and deploy production-ready generative AI solutions.

Benefits and Impact of Generative AI for Banks

The real question isn’t whether generative AI in banking works; it’s what tangible improvements your bank will see. Early adopters across the industry are already measuring results. Here’s what banks are actually experiencing as they deploy these solutions:

1. Operational efficiency

Generative AI for financial services automates repetitive cognitive tasks that consume your teams’ bandwidth. Document review that previously took weeks now completes in hours, while report generation shifts from manual compilation to automated synthesis.

Compliance checks run continuously rather than quarterly, freeing your teams from routine work to focus on strategic decisions. Processing volumes increase significantly without requiring proportional headcount growth.

2. Cost reduction

Automation delivers measurable financial impact through multiple channels. Labor costs decline as manual work disappears, error-related expenses drop with fewer compliance violations and fraud losses, and infrastructure costs are optimized through efficient cloud deployment. AI in banking transitions from expense to investment, with most implementations achieving measurable payback within 12–18 months.

3. Enhanced customer experience

Customers increasingly demand instant, personalized service across all channels, and generative AI in banking delivers exactly this capability. The system provides 24/7 availability without expanding support staff, offers personalized recommendations based on complete financial history, and resolves issues in minutes rather than days.

Fewer false fraud blocks interrupt transactions, while seamless omnichannel experiences let customers switch channels without losing context.

The result: higher satisfaction, increased loyalty, and reduced churn rates.

4. Faster decision-making

Speed creates competitive advantage in modern banking, and intelligent systems compress decision cycles dramatically. Loan approvals shrink from weeks to days, risk assessments are completed in hours instead of manual review cycles, and customer onboarding accelerates proportionally.

Fraud detection operates in real-time rather than batch processing, enabling regulatory responses within hours of requirement changes. Organizations competing on speed capture market opportunities first, whether by acquiring lending market share or accelerating customer acquisition.

5. Risk management and compliance

Real-time monitoring fundamentally changes how banks approach risk by triggering immediate investigation when suspicious patterns emerge rather than waiting for batch alerts. Compliance violations surface before they become regulatory issues, fair lending monitoring ensures consistent decision-making free from discrimination, and complete audit trails document every decision for regulatory review.

Your compliance team focuses on complex cases rather than manual alert review, while regulatory confidence increases when decision-making remains transparent and fully documented.

As banks move from pilots to full-scale adoption, the focus shifts to real-world impact. The next section highlights the key applications of generative AI transforming banking operations today.

Seven Key Applications of Generative AI in Banking

Generative AI is unlocking new opportunities across the banking value chain, enabling faster processes, smarter decisions, and more personalized customer experiences. Here are the seven most impactful generative AI use cases in financial services delivering measurable ROI across the industry.

1. AI-powered customer service and conversational banking

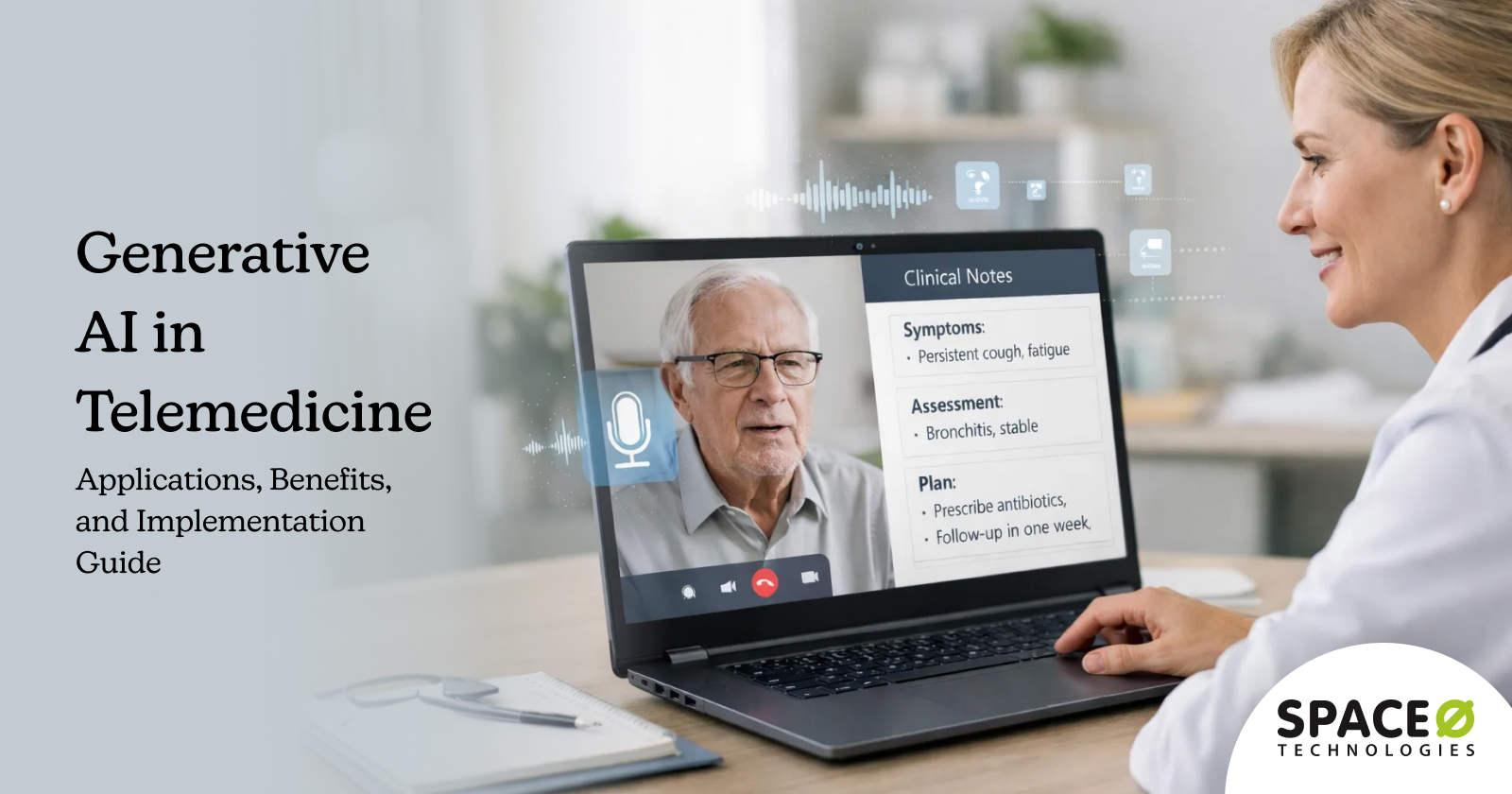

Virtual assistants and chatbots powered by generative AI handle customer inquiries 24/7, from simple balance checks to complex loan application guidance. These systems understand context, manage multi-turn conversations, and escalate intelligently to humans when needed.

Why it matters: Most banks field the same 200 questions repeatedly. Generative AI chatbots absorb that volume instantly, freeing your human team to solve genuinely complex problems that require judgment and empathy.

Real-world impact

- Wells Fargo’s generative AI chatbot, Fargo, has handled over 20 million interactions since its launch in March 2023, and the system reached 245.4 million interactions in 2024, more than doubling its original projections. The system doesn’t just provide answers; it explains loan options, clarifies fees, and guides customers through the application conversationally. [Source: VentureBeat]

- Customer service-related generative AI use, including chatbots and AI assistants, has more than doubled in financial services over the last year, rising from 25% to 60%. [Source: NVIDIA]

When building these solutions, focus on seamless CRM integration so chatbots can access the complete customer history, enabling personalized support instead of generic responses.

2. Real-time fraud detection and prevention

Machine learning models analyze transaction patterns, behavioral anomalies, and historical fraud data to flag suspicious activities instantly. Unlike traditional binary systems that simply block transactions, generative AI explains why something looks suspicious and recommends next steps.

Why it matters: Fraud doesn’t wait. Neither does modern customer expectation. You need systems that catch fraud while the customer is mid-transaction, not explaining false declines days later.

Real-world impact

- Mastercard’s AI improved fraud detection by as much as 300% in some cases. The system processes approximately 125 billion transactions annually, learning patterns across the entire payment network. [Marketcard]

- Fraud detection consistently delivers the highest ROI in banking AI applications, with leading institutions reporting significant annual savings.

- Systems that can explain why a transaction was flagged, “Explainable AI” (XAI), are essential for passing regulatory audits and getting your internal teams to trust the system.

3. Intelligent loan processing and credit scoring

Generative AI analyzes credit applications by examining not just traditional credit scores, but transaction history, cash flow patterns, alternative data sources, and broader economic indicators. This creates a more complete financial picture of applicants in minutes instead of weeks.

Why it matters: Traditional credit scoring misses people. Alternative data reveals creditworthiness that standard metrics overlook, enabling banks to safely approve more applicants while reducing bias in lending decisions.

Real-world impact

- Loan approvals that used to take weeks can now take minutes. AI-powered lending increases loan application review speed.

- A commercial bank can use a machine learning model to assess a loan applicant by analyzing their consistent utility payments, regular income deposits, and stable mobile phone usage. These alternative data points reveal creditworthiness that traditional scores miss, enabling approval of more applicants without increasing risk.

When you hire generative AI developers for lending automation, prioritize those with experience building explainable models that can withstand regulatory scrutiny and justify credit decisions to applicants.

4. Compliance automation and regulatory reporting

Generative AI reads thousands of pages of regulatory documentation, identifies compliance obligations, monitors transaction activity for violations, and auto-generates required reports. Systems maintain audit trails showing exactly how compliance decisions were made.

Why it matters: Compliance teams spend thousands of hours on manual document review and report generation. Regulatory requirements change constantly. Generative AI absorbs that burden and catches violations humans might miss through fatigue.

Real-world impact

- Citigroup used AI to review more than 1,000 pages of new capital rules, significantly speeding up its compliance process. [Bloomberg]

- In 2025, regulators worldwide, including the EU’s AI Act and emerging Asia-Pacific frameworks, will have expanded rules around explainability, bias detection, and AI governance in financial services. Generative AI systems built to meet these requirements provide a competitive advantage. [European Commission]

Banks with sophisticated compliance automation systems catch violations faster, respond to regulation changes immediately, and minimize fines. This is where generative AI examples in banking demonstrate real differentiation.

5. Personalized financial recommendations and wealth management

AI analyzes customer financial data, income patterns, spending habits, investment history, life stage, and risk tolerance to generate personalized product recommendations. Robo-advisors powered by generative AI deliver investment strategies, savings plans, and insurance suggestions tailored to individual circumstances.

Why it matters: Personalization at scale used to be impossible. You either offered generic products to everyone or hired armies of financial advisors. Now, generative AI delivers personalized advice instantly, improving customer outcomes and cross-sell rates dramatically.

Real-world impact

- Generative AI allows banks to deliver hyper-personalized services by analyzing customer-specific data such as transaction histories, income patterns, spending habits, and long-term financial goals. With these insights, AI-driven robo-advisors provide tailored recommendations for investments, savings plans, loans, and insurance products.

- J.P. Morgan Chase announced IndexGPT, an AI-powered tool designed to provide investment advice to retail clients in Latin America. This cloud-based service uses advanced AI to analyze and select financial assets tailored to each client’s needs, democratizing access to sophisticated investment tools. [Bloomberg]

Generative AI use cases in banking increasingly emphasize this personal touch, making customers feel understood rather than processed.

6. Anti-Money Laundering (AML) and Know Your Customer (KYC) automation

Generative AI extracts and verifies information from identity documents using Optical Character Recognition combined with ML. Systems flag inconsistencies, detect fraud attempts, and auto-populate compliance records. The technology continuously monitors transaction patterns for suspicious activity matching known laundering typologies.

Why it matters: KYC onboarding is both critical and tedious. Manual document review creates friction for legitimate customers while missing sophisticated laundering schemes. Automation speeds legitimate business while catching what humans miss.

Real-world impact

- A bank onboarding a new customer can use OCR and machine learning to instantly extract and verify information from their driver’s license and proof of address. If any details don’t match or look suspicious, the system flags it for review, speeding up approval while maintaining compliance and security.

- Generative AI strengthens AML programs by detecting suspicious patterns and adapting to new laundering techniques. Banks benefit from faster, more accurate compliance, reduced false positives, and minimized regulatory risk.

The best implementations combine OCR technology with generative AI reasoning; not just extracting data, but understanding context and flagging genuine risks.

7. Document processing and report generation

Generative AI reads, understands, and summarizes complex financial documents, loan files, regulatory filings, transaction records, and investment reports. Systems extract key information, identify risks or opportunities, and generate comprehensive summaries and insights automatically.

Why it matters: Banks drown in documents. Manual processing creates delays, errors, and inconsistent analysis. Generative AI processes volumes instantly while maintaining accuracy and consistency across the organization.

Real-world impact

- In consumer banking, handling documents like loan records, regulatory filings, and transaction records involves complex data so large that it’s difficult to process manually. Intelligent Document Processing (IDP) using AI identifies document types, summarizes documents, employs retrieval-augmented generation for answers, and organizes data automatically.

- Generative AI models are adept at processing data and producing comprehensive financial reports, forecasts, and performance analyses.

- Organizations are using AI to automate time-intensive tasks like document processing and report generation, driving significant cost savings and operational efficiency.

The seven use cases above represent where banks achieve the fastest ROI and most immediate competitive advantage. They’re also the foundation for building more sophisticated multi-agent systems that combine these capabilities into automated workflows.

Pro Tip: Start with the use case that addresses your biggest operational pain point. If customer service volume is overwhelming your team, begin with conversational AI. If fraud losses are bleeding your bottom line, prioritize fraud detection. One successful implementation builds internal expertise and confidence for scaling additional generative AI use cases in banking across your organization.

Modernize Banking Operations with Proven Gen AI Expertise

With more than 15+ years of experience and more than 500+ AI solutions delivered, Space-O AI helps financial institutions adopt generative AI with confidence and clarity.

Understanding the Technology Stack Behind Banking Generative AI Technology

Each of these banking-specific applications shares a common foundation: generative AI in banking requires connecting large language models to your actual data through Retrieval Augmented Generation (RAG). This prevents hallucinations and grounds AI responses in your customer data, transaction records, and compliance documentation.

When you partner with experienced generative AI developers to build these systems, they implement:

- LLMs (GPT-4, Claude, LLaMA) trained on financial language and regulatory terminology

- RAG architectures that pull live data from your core banking systems

- Vector databases enabling semantic search across your documentation

- Cloud infrastructure (AWS Bedrock, Azure OpenAI Service, Google Vertex AI) with enterprise compliance

- Explainability layers ensuring regulatory teams understand how every AI decision was made

Because these architectures require careful orchestration across multiple systems, banks often rely on generative AI integration services to guide this stage. This allows them to tap into proven expertise that speeds up deployment and reduces the internal effort required to get reliable, production-ready AI systems.

These technical foundations are powerful, but they’re only part of the story. The real complexity emerges when banks attempt to implement these systems in production environments. Most financial institutions face significant obstacles that go beyond technology itself.

Common Challenges in Generative AI Banking Implementation and How to Address Them

While Gen AI in banking promises significant transformation, the path from pilot to production reveals substantial obstacles. Understanding these challenges and their proven solutions, often gained through partnerships with experienced generative AI development companies, separates banks that successfully deploy AI from those stuck in expensive experiments.

Challenge 1: Data quality and fragmentation

Many financial institutions struggle with fragmented data ownership and governance that limit their ability to adopt Gen AI at scale. Contradictory data, such as outdated records or inconsistent formats, leads to unreliable AI outputs, requiring significant investment in data governance frameworks to ensure accuracy and ethical use.

Solution

- Implement centralized data governance frameworks that standardize formats, definitions, and update cycles

- Use data mesh architectures to work with siloed, fragmented legacy data rather than requiring complete consolidation

- Conduct regular data audits to identify and resolve inconsistencies before feeding data into AI models

- Establish a single source of truth for critical customer and transaction data

Challenge 2: Legacy system integration complexity

Most banks operate with legacy core banking systems that lack modern APIs and flexible connections, making integration with AI solutions expensive and risky. Legacy infrastructure creates significant barriers to rapid AI adoption and creates delays in realizing value.

Solution

- Develop a modular, cloud-based architecture that supports AI deployment without requiring complete legacy system replacement

- Implement modern APIs that enable interoperability between legacy systems and new AI applications

- Use middleware solutions that bridge legacy systems with AI platforms securely

- Prioritize modernizing systems with open API architectures

- Explore managed service providers for smaller institutions where internal technical complexity is overwhelming

Challenge 3: Regulatory compliance and explainability

Banking operates under strict regulations demanding transparency and explainability. Regulators require a clear understanding of how AI makes decisions, especially in high-stakes areas such as credit scoring and fraud detection. Banks must build systems that can be audited and explained to regulatory authorities.

Solution

- Build explainability into AI models from the beginning, using tools like LIME or SHAP to trace decisions

- Start with low-risk use cases like customer FAQs before moving to high-stakes applications like credit decisions

- Engage regulators early and transparently, especially for lending and financial advice applications

- Implement robust audit trails showing exactly how every AI decision was made

- Conduct regular bias audits using diverse, representative training datasets

Challenge 4: Data security and privacy risks

Generative AI processes vast amounts of sensitive customer data. Data breaches expose millions of records, destroy trust, and trigger regulatory penalties. Banks must implement comprehensive security controls to protect customer information and maintain compliance with data protection regulations.

Solution

- Implement a privacy-first architecture where sensitive data is scrubbed and tokenized locally before reaching AI models

- Deploy small language models (SLMs) to detect and remove PII before data reaches large language models

- Use data encryption, strict access controls, and authentication protocols

- Maintain detailed audit logs of all data access and AI decision-making

- Consider on-premise or private cloud deployment for highly sensitive applications

Challenge 5: Model bias and fairness

AI models trained on historical banking data inherit embedded biases. Systems trained on decades of biased lending decisions perpetuate and amplify those biases, creating legal liability and regulatory violations. Systematic bias in credit scoring disproportionately affects certain customer groups.

Solution

- Train AI models on diverse and representative datasets reflecting your actual customer population

- Implement bias detection tools to audit models regularly for unfair patterns

- Develop ethical guidelines governing AI development and deployment

- Ensure human review for significant credit decisions, especially early in deployment

- Maintain transparency by explaining credit decisions to applicants

Challenge 6: Change management and adoption barriers

Implementing generative AI requires organizational change beyond technology. Employee resistance, lack of AI literacy, and concerns about job displacement slow adoption. Without clear change management, even well-designed systems fail to achieve real-world usage and value realization.

Solution

- Frame AI as a “copilot” that enhances human work rather than replacing it

- Invest in comprehensive training programs for employees across all levels

- Communicate clearly how AI eliminates tedious work and enables more strategic responsibilities

- Start with early adopters and champions who demonstrate success to skeptical colleagues

- Involve staff in implementation decisions to build buy-in and gather practical insights

Challenge 7: ROI measurement and implementation costs

Generative AI requires significant upfront investment in hardware, software, integration, and data preparation. Quantifying ROI can be difficult when benefits like improved customer satisfaction are diffuse or long-term. Many pilots demonstrate value but struggle to secure approval for broader deployment.

Solution

- Start with high-impact use cases where ROI is clear and measurable

- Use phased rollouts to spread costs and validate the business case before full commitment

- Establish clear success metrics before implementation, and define what “success” means quantitatively

- Track cost avoidance (fraud prevented, labor reduced, errors eliminated) alongside revenue gains

- Consider automation-as-a-service models that spread costs over time rather than requiring massive upfront capital

Successful Gen AI in banking implementations succeed not because the technology is better, but because institutions address data quality first, modernize critical infrastructure second, and build comprehensive governance frameworks throughout. The technology works. Execution strategy determines success.

Understanding these challenges is the first step. Now comes the practical work: implementing generative AI banking solutions in a way that actually works. Here’s a straightforward roadmap.

Start Your Generative AI Implementation with Expert Guidance

From use case identification to model deployment, Space-O AI helps you build and scale Gen AI initiatives that deliver real business value for your bank.

Steps to Successfully Implement Generative AI in Banking

Implementing generative AI in banking is a journey, not a sprint. Banks that succeed follow a structured six-step process that minimizes risk, validates assumptions at each stage, and builds organizational confidence. Here’s the proven roadmap.

Step 1: Define your use case and establish baselines

Start with one specific problem where AI delivers clear value. Define success metrics upfront; will you measure by cost reduction, customer satisfaction, fraud prevention, or processing speed? Establish your current baseline performance to track improvement and audit your data quality and system architecture readiness.

Step 2: Build your team and assess infrastructure

Assemble the right mix of skills: data engineers, ML specialists, compliance experts, and domain experts. Simultaneously, assess your data governance, system architecture, and integration capabilities to understand what modernization is required before AI deployment.

Step 3: Design your solution architecture

Work with your team to design how data flows, which models you’ll use, how decisions get made, and how you’ll maintain explainability and compliance. Plan for security, privacy safeguards, audit trails, and bias detection requirements.

Step 4: Launch a pilot program (parallel to current systems)

Deploy your solution to a limited user group or specific business unit. Run it alongside existing systems, don’t replace them yet. Collect feedback, monitor performance against your metrics, analyze results, and retrain models with real data before full rollout.

Step 5: Scale gradually across your organization

Once the pilot proves value, roll out in phases to additional business units or geographies. Spread costs, build organizational confidence, and refine processes as you expand. Train employees on AI-augmented workflows and get regulatory sign-off for high-stakes decisions.

Step 6: Establish continuous governance and monitoring

AI isn’t “set it and forget it.” Establish ongoing monitoring, regular model retraining, bias audits, and performance tracking. Set up dashboards, schedule quarterly reviews, document all changes for compliance, and plan for updates as regulations evolve.

Your Data Is Worth Millions. Are You Using It?

Space-O, backed by 15+ years of AI expertise, transforms raw banking data into intelligent AI systems that predict customer needs, prevent fraud, and optimize decisions at scale.

Partner with Space-O AI to Build Secure and Scalable Gen AI Systems for Banking

Generative AI is becoming a critical pillar in the digital transformation of modern banking. With rising customer expectations, increasing regulatory complexity, and the constant need for faster and more accurate decision-making, financial institutions are turning to generative AI to strengthen operations and deliver better experiences.

From automating customer support to accelerating credit underwriting and improving fraud detection, the use cases continue to expand as banks recognize the value of intelligent systems that can understand context, analyze data, and generate actionable insights in real time.

Space-O AI works closely with banking and financial institutions to design and develop custom generative AI solutions tailored to their unique needs. With more than 15 years of experience as a leading AI development agency and a proven track record of building over 500 AI-powered solutions, Space-O AI brings deep technical expertise and a strong understanding of banking workflows.

We help banks streamline operations, improve customer experience, strengthen compliance, and create intelligent automation across key functions. Whether you need a generative AI chatbot for customer service, an automated loan processing engine, advanced fraud analysis tools, or a custom model that supports internal teams, our team provides end-to-end support from strategy to deployment.

If your organization is planning to explore generative AI or is ready to build a custom solution, book a free consultation with our AI experts and discover how we can help you move forward with confidence.

Frequently Asked Questions About Generative AI in Banking

How much does generative AI implementation cost for banking institutions?

Pilot projects typically range from $50K–$300K, depending on complexity and scope. Mid-scale implementations for single departments (like customer service or fraud detection) span $300K–$2M.

Full organization-wide, enterprise-scale implementation can exceed $2M based on infrastructure requirements, data integration complexity, compliance needs, and cloud infrastructure costs. Most institutions recoup their investment within 12–24 months through labor savings, error reduction, and improved operational efficiency.

How long does generative AI implementation take?

Pilot phase takes 8-12 weeks. Full deployment across your organization typically requires 6-12 months, depending on complexity and scope. The timeline varies based on data readiness, legacy system integration requirements, and regulatory approval needs.

Banks that start with one high-impact use case and scale gradually move faster than those attempting everything at once.

How quickly can we see ROI from generative AI implementation?

ROI timelines vary by use case. High-impact applications like fraud detection and document processing typically show measurable benefits within 3–6 months. Pilot projects can validate business cases within 8–12 weeks.

Full organization-wide ROI depends on your implementation scope and complexity. Most banks recoup their investment within 12–24 months through labor savings, error reduction, and improved efficiency. Start with one high-impact use case, prove value, then scale gradually.

How do we handle AI bias in credit decisions?

Bias in AI in banking use cases, like credit scoring, is a critical challenge. Train models on diverse, representative datasets reflecting your actual customer population. Implement regular bias audits using tools that identify unfair patterns.

Maintain human review for significant credit decisions, especially in early deployment. Ensure transparency by explaining credit decisions to applicants so they understand how AI factors into approval or denial. Build ethical guidelines into your AI governance framework from the start.

How does generative AI handle customer data privacy?

Privacy-first architecture ensures customer data never reaches external AI models. Instead, sensitive information is processed locally through smaller language models that detect and strip personally identifiable information.

Only anonymized, scrubbed data is sent to large language models for processing. Banks maintain detailed audit logs showing exactly how data was handled. Encryption, access controls, and compliance frameworks (GDPR, HIPAA) protect information throughout the process.

Can generative AI replace human banking staff?

No. Generative AI augments human work; it doesn’t replace it. AI handles repetitive, time-consuming tasks like data entry, document processing, and initial customer inquiries, freeing employees to focus on complex problem-solving, relationship-building, and strategic decisions.

Employees become more productive, and their work becomes more interesting. The bigger challenge is change management: helping teams understand AI as a “copilot” that makes their jobs better, not a threat.

Build Custom Gen AI Solutions for Your Bank

What to read next