- What Is AI in Risk Management?

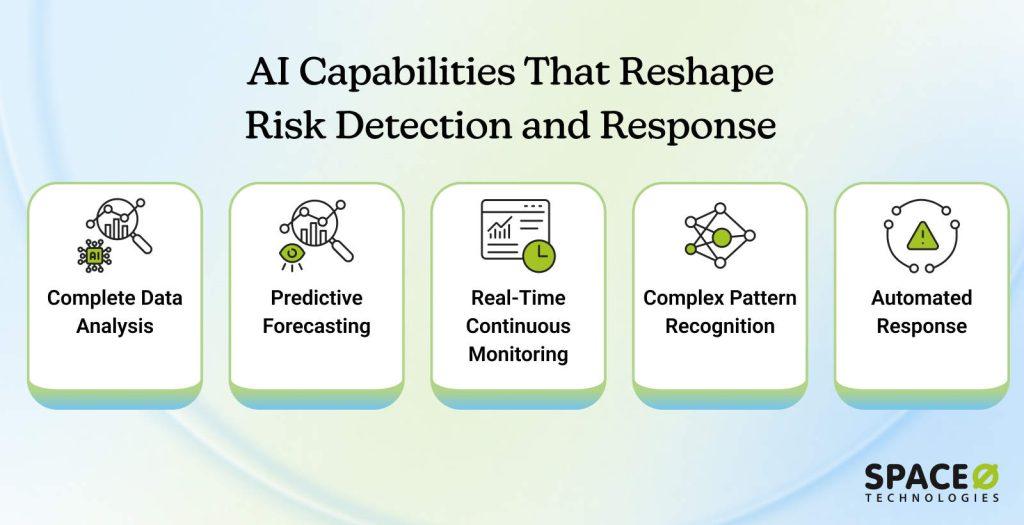

- How Modern AI Reshapes Risk Management: Five Key Capabilities

- Key Benefits of AI-Driven Risk Management

- 1. Dramatically improved risk detection

- 2. Faster response times and real-time decision-making

- 3. Massive cost reduction and improved profitability

- 4. Enhanced accuracy and consistency

- 5. Proactive risk management instead of reactive fire-fighting

- 6. Better decision-making with data-driven insights

- 7. Scalability without linear cost increases

- 8. Regulatory compliance and risk mitigation

- 9. Reduced organizational liability and exposure

- 10. Competitive advantage and strategic positioning

- AI in Risk Management Across Industries: Real-World Applications

- Challenges in Implementing AI Risk Management: Solutions and Best Practices

- Tips for Successful Implementation of AI-Driven Risk Management

- Partner with Space-O AI to Enable AI in Your Risk Management Strategy

- Frequently Asked Questions About AI in Risk Management

- 1. How does AI in risk management differ from traditional risk management?

- 2. What’s the typical timeline for AI risk management implementation?

- 3. How does AI handle bias and fairness in risk management?

- 4. What skills do we need internally to manage AI risk management systems?

- 5. How do we handle regulatory compliance with AI risk management?

- 6. Can smaller organizations implement AI risk management?

AI for Risk Management: Real World Use Cases and Implementation Steps

Risk is becoming more unpredictable, interconnected, and data-heavy than ever before. Traditional risk management methods struggle to keep up because they rely on manual analysis, historical trends, and periodic reviews. Modern businesses need faster insights, real-time monitoring, and a proactive approach that can identify threats before they escalate. That is where artificial intelligence steps in.

According to Moody’s research, 41 percent of respondents are already applying AI for risk management, and another 45 percent are actively considering it. The shift is happening fast because AI helps teams analyze massive volumes of data, detect anomalies instantly, and predict emerging risks with far greater accuracy.

From fraud detection to supply chain forecasting, AI-powered systems are transforming how companies stay resilient. As risks grow more complex, AI gives teams the ability to respond quickly, reduce losses, and make smarter decisions.

In this guide, you will learn how AI is reshaping risk management, the key benefits, real-world use cases, and the tools that help companies strengthen their overall risk strategy. Get insights from our experience as a leading AI software development company and strengthen your security framework with AI.

What Is AI in Risk Management?

AI in risk management refers to the use of artificial intelligence technologies such as machine learning, natural language processing, predictive analytics, and automation to identify, assess, and mitigate risks more accurately and efficiently. Instead of relying only on manual reviews or historical data, AI-powered systems analyze large and complex data sets in real time to uncover patterns, anomalies, and signals that humans may miss.

At its core, AI enhances the traditional risk management lifecycle. It strengthens risk identification by scanning structured and unstructured data across systems, emails, transactions, customer interactions, and external sources. It improves risk assessment with predictive models that estimate the likelihood and impact of future threats.

AI also supports risk mitigation by triggering alerts, automating workflows, and guiding teams toward the right decisions. Companies use AI to find early warning signs of financial, operational, compliance, cyber, and supply chain risks.

Why AI is Essential for Your Risk Management Strategy

Organizations face mounting pressure from multiple directions simultaneously. Understanding these forces reveals why AI has shifted from optional to essential.

1. Regulatory pressure

The EU AI Act is now in effect, with GDPR, HIPAA, state privacy laws, and industry-specific regulations multiplying rapidly. Regulators increasingly expect proactive, documented risk management. Organizations that demonstrate sophisticated governance frameworks face significantly less regulatory scrutiny and fewer compliance challenges.

2. Threat sophistication

Cybersecurity attacks evolve faster than traditional manual monitoring can respond. Fraud schemes grow increasingly complex and harder to detect. Supply chain disruptions multiply across interconnected global networks.

As operational systems become more interdependent, risks cascade faster and impact broader business areas. Manual processes simply can’t keep pace with these evolving threats.

3. Data volume explosion

Modern organizations generate terabytes of data daily across transaction systems, networks, sensors, and operational platforms. A single bank processes millions of transactions. Networks generate constant traffic streams.

Sensors provide continuous equipment and environmental readings. No human team, regardless of size or expertise, can meaningfully analyze this volume manually or identify patterns within it.

4. Competitive gap

This convergence of pressures creates a clear competitive divide. Organizations deploying AI risk management responsibly gain a measurable advantage over competitors relying on manual processes.

They identify threats faster. They respond quicker. They prevent problems instead of managing crises. Those who delay will eventually scramble to catch up after competitors move ahead.

So, how exactly does AI change risk management? What capabilities enable organizations to transform from reactive, manual processes to proactive, automated detection? The answer lies in five core capabilities that work together to reshape how organizations identify and respond to risk fundamentally.

Build a Smarter, AI-Ready Risk Management System

Work with Space O AI to create AI-powered tools that reveal hidden risks, improve forecasting, and reduce manual effort. We help you upgrade from reactive risk management to a proactive and data-driven approach.

How Modern AI Reshapes Risk Management: Five Key Capabilities

Modern artificial intelligence in risk management reshapes how organizations detect threats through five interconnected capabilities. These work together to identify risks faster, predict problems earlier, and respond more effectively than traditional approaches.

Capability 1: Complete data analysis

Traditional risk management relies on sampling. You can’t review every transaction, so you review a sample. This creates blind spots where threats hide. AI and risk management change this by analyzing 100% of data instantly.

A bank processing 100 million daily transactions can’t rely on human review. AI analyzes all 100 million, flagging suspicious patterns within minutes. This completeness transforms detection from probabilistic to comprehensive.

An AI system analyzing complete data catches patterns that show up in 0.01% of transactions. Human teams sampling 1% of data would miss these patterns entirely.

Capability 2: Predictive forecasting

How can AI assist in risk management? By shifting from reactive to proactive approaches. Rather than discovering problems after they happen, predictive models forecast which risks will likely materialize.

A credit model learns what borrower characteristics predict defaults, then applies these patterns to new applicants to forecast risk before approvals happen.

Similarly, an equipment maintenance model learns what sensor readings precede failures and forecasts which machines will fail in the next 30 days, enabling planned maintenance instead of costly emergency replacement. In both cases, prediction enables prevention.

Capability 3: Real-time continuous monitoring

Traditional risk assessment is periodic. You assess quarterly or annually. Between assessments, you don’t know if risks have changed. Artificial intelligence for risk management operates 24/7 without fatigue.

When suspicious patterns emerge, systems detect them immediately. When network traffic shows attack behavior, alerts trigger in real time. When equipment readings cross thresholds, notifications go out instantly.

This continuous operation catches problems within minutes instead of weeks.

Capability 4: Complex pattern recognition

Human analysts see relationships between a few variables. Modern business is too complex for this. Fraudsters might disguise patterns by varying amounts, spacing transactions over time, using different channels, and involving multiple accounts simultaneously.

AI systems identify patterns across hundreds of variables at once. They see relationships that would be invisible in traditional analysis. A supply chain disruption might result from geopolitical tension, adverse weather, supplier instability, and competing demand simultaneously. Individual analysis of each factor misses the pattern.

AI analyzes all factors together and forecasts the disruption.

Capability 5: Automated response

Detecting a risk is only half the battle. You also need to respond quickly. AI automates response workflows, so pre-programmed actions trigger automatically when risks are detected.

A suspicious transaction is held automatically. A security attack triggers automatic network segmentation. A compliance violation triggers automatic reporting. Equipment failure prediction triggers automatic maintenance scheduling.

This automation reduces response time from days to seconds and ensures consistent application of rules.

Knowing the mechanics is valuable. Seeing the results is transformative. Organizations deploying these capabilities are already reporting tangible, measurable returns. Let’s examine the concrete benefits driving this rapid AI adoption across industries.

Key Benefits of AI-Driven Risk Management

Organizations deploying AI in risk management report measurable returns across multiple dimensions. These aren’t theoretical improvements. They’re concrete results happening right now across finance, healthcare, manufacturing, and other industries.

1. Dramatically improved risk detection

AI in risk detection identifies risks humans miss with absolute consistency. Unlike human analysts prone to fatigue, AI maintains identical performance 24/7, getting threats identified instantly and catching fraud patterns while flagging compliance violations. Prevention is far cheaper than crisis management.

2. Faster response times and real-time decision-making

Speed matters enormously in AI and risk management. When fraud happens right now, detecting it in real time versus a weekly review saves millions. AI systems compress response timelines dramatically, blocking suspicious transactions within seconds, triggering automatic network isolation, and reporting compliance violations immediately. This speed prevents incidents from escalating into crises.

3. Massive cost reduction and improved profitability

AI automates expensive manual processes, freeing risk analysts to shift toward strategic work instead of data compilation. Equipment failures are prevented through prediction, which helps avoid emergency replacement costs, while fraud detected early prevents massive losses. Organizations simultaneously reduce labor costs and prevent losses from undetected risks. ROI compounds over time.

4. Enhanced accuracy and consistency

AI maintains identical performance quality throughout operating periods without fatigue, applying the same decision criteria consistently day after day. This consistency improves compliance audit outcomes while regulators increasingly expect consistent, documented risk controls. AI provides audit trails proving systematic policy application across the organization.

5. Proactive risk management instead of reactive fire-fighting

Traditional risk management reacts after problems happen, while AI-powered predictive systems forecast problems before they materialize. Credit models predict defaults before approvals, equipment models predict maintenance needs before failures occur, and supply chain systems predict disruptions before shortages happen.

This shift enables prevention, which costs far less than crisis management and creates a strategic competitive advantage.

6. Better decision-making with data-driven insights

AI systems provide comprehensive analysis instead of incomplete information, transforming decision quality across the organization. Rather than generic risk assessments, systems recommend “optimal pricing given risk profile” or “maximum supplier exposure given default probability.”

Board discussions are grounded in data rather than opinion, enabling better strategic decisions that balance opportunity against risk appropriately.

7. Scalability without linear cost increases

Implement once, deploy across multiple locations without requiring proportional staff increases. Volume growth gets handled by the same system with minimal incremental cost, making year-one investment pay dividends through year-three as per-unit monitoring costs decline dramatically.

This economic model supports business expansion without proportional expense increases.

8. Regulatory compliance and risk mitigation

AI demonstrates proactive risk management through continuous 24/7 monitoring that beats periodic manual audits and creates automated audit trails proving consistent compliance. Organizations with strong governance face less regulatory scrutiny, and AI systems that adapt automatically when regulations change show genuine sophistication.

Regulatory relationships improve measurably when competence is demonstrated through systematic controls.

9. Reduced organizational liability and exposure

Documented systematic risk management reduces legal liability significantly by strengthening legal defense with evidence of proactive monitoring. Insurance companies recognize sophisticated risk management with better terms, regulatory fines decrease for organizations demonstrating proactive compliance, and litigation risk drops substantially with evidence of systematic approaches. This protection matters when incidents eventually occur.

10. Competitive advantage and strategic positioning

Early movers build competitive advantages lasting years because organizations using AI make better decisions faster than competitors relying on manual processes. In crises, AI-enabled organizations recover faster because they predicted disruptions and prepared accordingly.

Investors view sophisticated AI risk management as professional management, giving early adopters a sustained market advantage.

These benefits aren’t confined to one industry or business model. Organizations across finance, healthcare, manufacturing, supply chain, cybersecurity, and retail are already deploying AI to capture these advantages. Let’s explore how specific industries are applying these capabilities to solve real business challenges.

Modernize Risk Management with Enterprise AI Solutions

Accelerate your AI adoption with secure, scalable, and high-impact AI systems. Our experts design and deploy custom models that improve accuracy, reduce risk exposure, and support better business decisions.

AI in Risk Management Across Industries: Real-World Applications

Artificial intelligence in risk management creates measurable value across every industry. Organizations aren’t waiting for perfect conditions. They’re solving real business problems right now. Let’s explore how specific sectors apply AI capabilities to their unique risk landscapes.

1. Financial services and banking

Banks operate in a high-stakes environment where even minor errors cascade into massive financial losses. AI-powered risk management is transforming how financial institutions detect fraud, assess credit, and maintain compliance at scale.

1.1 Fraud detection and prevention

Banks process millions of daily transactions. Manual monitoring simply cannot keep pace with transaction volume or fraud sophistication.

- Challenge: Millions of daily transactions exceed manual monitoring capacity

- Solution: AI in risk and compliance systems analyzes complete transaction datasets in real time, flagging suspicious patterns instantly. Machine learning models identify what normal behavior looks like, detecting deviations that suggest fraud.

- Result: Major banks reduced fraud detection from hours to seconds, blocking fraudulent transactions before completion

1.2 Credit risk assessment

Traditional credit underwriting examines limited variables. AI transforms this by analyzing far more data points comprehensively.

- Challenge: Traditional underwriting uses limited variables

- Solution: AI models analyze payment history, debt ratios, income stability, employment patterns, behavioral signals, and alternative data sources simultaneously

- Result: More accurate risk profiles; improved loan portfolio performance and better lending decisions

1.3 Compliance monitoring

Financial institutions face relentless regulatory demands. AML, KYC, and transaction reporting require constant vigilance.

- Challenge: AML, KYC, and transaction reporting require continuous vigilance

- Solution: AI and risk management systems monitor transaction data 24/7, flagging violations automatically with detailed evidence

- Result: Immediate alerts trigger when thresholds are exceeded; compliance teams investigate faster

2. Healthcare and life sciences

Healthcare organizations operate under intense pressure to deliver superior patient outcomes while managing operational complexity. AI is enabling earlier risk identification and more proactive clinical interventions across the entire patient care journey. Organizations looking to implement these capabilities often partner with a healthcare software development company to build custom risk management solutions tailored to clinical workflows.

2.1 Clinical risk prediction

Healthcare organizations increasingly recognize that predicting patient risk enables early intervention and better outcomes.

- Challenge: Need to identify high-risk patients before complications develop

- Solution: AI models analyze medical histories, lab results, vital signs, medications, and comorbidities to identify patterns preceding adverse events

- Result: Improved patient outcomes; reduced complication rates through earlier clinical intervention

2.2 Medical device and drug safety

Pharmacovigilance requires monitoring adverse events across complex healthcare systems and multiple data sources.

- Challenge: Adverse events must be detected across multiple data sources in real time

- Solution: AI aggregates data from multiple sources, identifying statistical signals faster than manual review processes

- Result: Rapid response when safety concerns emerge; faster time from identification to action

2.3 Workplace safety

Healthcare facilities are inherently high-risk environments for worker injuries. Proactive detection prevents incidents.

- Challenge: Healthcare facilities have high worker injury rates

- Solution: Wearable sensors and computer vision detect unsafe conditions in real time, identifying ergonomic risks and fatigue indicators

- Result: Organizations report a reduction in workplace injury incidents

3. Cybersecurity and data protection

Cybersecurity threats have become existential risks for organizations. AI-powered systems that learn and adapt in real time are now essential for defending against sophisticated attacks and identifying vulnerabilities before exploitation.

3.1 Threat detection

Cybersecurity threats evolve faster than traditional monitoring systems can adapt. AI-powered systems learn and evolve with threats.

- Challenge: Cybersecurity attacks evolve constantly; rule-based systems miss new variations

- Solution: AI learns attack patterns automatically and identifies new threat variations; machine learning models analyze network traffic, user behavior, and system logs continuously

- Result: Detection time reduced from hours to seconds for many organizations

3.2 Vulnerability management

Modern systems contain hundreds or thousands of vulnerabilities. Prioritization based on actual threat data outperforms severity-only approaches.

- Challenge: Systems have numerous vulnerabilities; teams must prioritize remediation effectively

- Solution: AI forecasts which vulnerabilities are most likely to be exploited based on threat intelligence and attacker capabilities

- Result: Teams prioritize based on actual exploitation probability, not just technical severity ratings

3.3 Vendor risk assessment

Third-party vendor security assessment traditionally required extensive manual effort. AI accelerates this process significantly.

- Challenge: Manual vendor questionnaires are time-consuming and inconsistent across assessments.

- Solution: AI-powered platforms analyze questionnaires, financial data, and certifications in real time, systematically.

- Result: Significant reduction in due diligence turnaround time.

4. Manufacturing and supply chain

Manufacturing competitiveness depends on operational efficiency and supply chain reliability. AI is enabling predictive maintenance that prevents costly downtime, supply chain visibility that prevents disruptions, and quality systems that eliminate defects before products reach customers.

4.1 Predictive maintenance

Equipment downtime represents one of manufacturing’s highest hidden costs. Predictive approaches prevent failures before they occur.

- Challenge: Equipment downtime costs significant sums; unplanned failures occur between scheduled maintenance windows

- Solution: IoT sensors combined with AI forecast equipment predict failures before breakdown, enabling planned maintenance

- Example: Large manufacturer detected the majority of equipment failures in advance, reducing downtime substantially and saving significant capital in the first year

- Result: Shifted from emergency repairs to planned maintenance; reduced unexpected operational disruptions

4.2 Supply chain risk prediction

Modern supply chains face multiple simultaneous disruption risks. AI synthesizes diverse data sources to predict disruptions weeks in advance.

4.3 Quality control

Manual sampling inspection inherently misses defects. 100% inspection through computer vision ensures consistent quality.

- Challenge: Manual sampling inspection catches some defects; others slip through to customers

- Solution: Computer vision combined with AI enables comprehensive inspection at production speed, analyzing every product

- Example: A leading automotive manufacturer implemented automated optical inspection, reducing defect rates substantially within a year

- Result: Fewer defects reach customers; brand reputation strengthened through consistent quality

Manufacturing organizations face unique challenges requiring specialized AI implementations. Custom AI manufacturing software development services help companies integrate predictive models with shop floor systems, quality control processes, and supply chain networks.

5. Insurance and risk transfer

Insurance success depends on accurate risk assessment and efficient claims processing. AI is enabling underwriters to identify patterns in risk data that humans miss, assess claims faster, and intervene proactively before problems escalate.

5.1 Claims processing

Traditional claims assessment takes weeks. AI-powered damage assessment dramatically accelerates the process.

- Challenge: Adjusters spend extended time assessing damage manually with on-site visits and photo review

- Solution: AI analyzes photos automatically; computer vision identifies damage types and severity

- Result: Faster assessment and approval; claimants receive settlements quickly; fraud detection improves

5.2 Underwriting intelligence

Different underwriters make different decisions on similar applications. AI models ensure consistency.

- Challenge: Different underwriters make different decisions on similar applications; consistency is difficult to maintain

- Solution: AI models identify patterns in high-loss outcomes, then assess new applicants consistently based on data

- Result: More consistent decisions; improved portfolio performance through better risk assessment

5.3 Policyholder monitoring

Continuous monitoring identifies deteriorating policies before claims escalate significantly.

- Challenge: Need early warning when policies begin showing deteriorating risk profiles

- Solution: Predictive models identify high-risk policies; flag deteriorating profiles before claims escalate

- Result: Proactive intervention reduces claims; organizations maintain better margins through early identification

6. Retail and eCommerce

Retail margins are thin, and competition is fierce. AI is helping retailers optimize inventory, detect fraud across all channels, and respond to reputation threats in real time before they impact brand value.

6.1 Inventory forecasting

Optimal inventory levels require analyzing multiple data streams simultaneously. AI synthesizes these inputs effectively.

- Challenge: Too much stock wastes capital; too little stock causes stockouts and lost sales

- Solution: AI analyzes historical sales, seasonal patterns, weather, local events, competitor activity, and social trends together

- Result: Optimal inventory levels maintained; fewer stockouts and excess inventory; improved working capital

6.2 Fraud detection

Retail fraud occurs across multiple touchpoints. AI detects patterns humans miss across all channels.

- Challenge: Fraud happens at the point of sale, in inventory management, and in returns processing

- Solution: AI analyzes transaction patterns, employee behavior, and inventory discrepancies automatically

- Result: Faster fraud detection; reduced workplace theft and return fraud; improved profitability

6.3 Reputation monitoring

Social media spreads negative events instantly. Real-time monitoring enables rapid response.

- Challenge: Negative events spread instantly through social media channels

- Solution: AI monitors social platforms, news sources, and review sites for brand reputation threats in real time

- Result: Organizations respond quickly before small issues become major reputation crises

7. Legal and compliance

Legal and compliance departments face constant pressure to reduce risk while maintaining operational efficiency. AI is automating document review, tracking regulatory changes, and supporting litigation strategy with data-driven analysis.

7.1 Contract analysis

Manual contract review is time-consuming and often incomplete. AI extracts and flags risks systematically.

- Challenge: Manual contract review consumes significant time and requires specialized legal expertise

- Solution: AI extracts key clauses, identifies legal risks, and flags compliance issues automatically

- Result: Faster due diligence; problematic contracts identified before commitment; accelerated deal completion

7.2 Regulatory tracking

Regulations change constantly across multiple jurisdictions. Manual tracking cannot keep pace.

- Challenge: Regulations change constantly across multiple jurisdictions; impact assessment is complex

- Solution: AI monitors regulatory changes, assesses operational impact, and flags compliance gaps automatically

- Result: Proactive compliance maintained; audit preparation simplified

7.3 Litigation risk

Historical case data contains patterns predicting outcomes. AI identifies these patterns to support decision-making.

- Challenge: Historical case data reveals patterns predicting litigation outcomes; analysis is resource-intensive

- Solution: AI analyzes case history, comparable cases, and legal precedent to predict likely outcomes

- Result: Better-informed settlement and litigation strategy decisions

These applications showcase AI’s power across industries. But implementation comes with real challenges. Understanding these obstacles upfront enables smarter deployment and better outcomes.

Start Your AI Integration Journey for Risk Management

Whether you want predictive models, automated risk scoring, or real-time anomaly detection, Space O AI can help you build the right AI framework. Schedule a consultation to explore what AI can solve for your organization.

Challenges in Implementing AI Risk Management: Solutions and Best Practices

Every AI implementation faces obstacles. Some are technical. Some are organizational. Some are regulatory. The good news: none are insurmountable. Organizations successfully deploying artificial intelligence in risk management have developed practical solutions for each challenge. Let’s examine what you’ll likely encounter and how to overcome it.

1. Algorithmic bias and fairness

Machine learning models trained on biased historical data perpetuate and amplify those biases. This leads to discrimination, unfair treatment, and legal liability. Real-world cases demonstrate that AI recruiting and facial recognition systems can perpetuate systemic discrimination against protected groups.

Solutions

- Audit training data for existing biases before model development; ensure diverse dataset representation across demographics and geographies

- Implement regular bias testing both before and after deployment across all population segments

- Keep humans in the loop for final decisions in sensitive areas like hiring, lending, and benefits determinations

- Build transparency into model design using explainable AI methodologies to understand decision-making

2. Data quality and governance

AI risk management solutions depend on a sufficient quantity and quality of data. Healthcare and finance data often fragments across legacy systems with inconsistent formatting. Poor-quality data produces poor model decisions. Without strong data governance, AI projects fail or produce unreliable results.

Solutions

- Invest in data governance infrastructure before deploying AI systems; build automated pipelines for continuous clean data flow

- Use synthetic data augmentation to address gaps, especially for rare conditions or events

- Implement master data management, standardizing formats and ensuring consistency across systems

- Establish data quality monitoring dashboards that track performance metrics continuously

3. Model drift and performance degradation

Real-world conditions change over time. Models trained on historical data don’t automatically adapt. Performance degrades as data distribution shifts. “Black box” models make performance issues hard to diagnose. Continuous monitoring and retraining become essential but resource-intensive.

Solutions

- Implement continuous model performance monitoring with automated alerts for degradation triggers

- Establish automated retraining schedules based on performance thresholds and data distribution changes

- Monitor for data distribution drift separately from accuracy metrics to catch emerging issues early

- Maintain version control and rollback capabilities, enabling quick recovery if models underperform

4. Integration with legacy systems

Enterprise systems often run on legacy platforms lacking modern APIs. Integration complexity increases implementation costs and timelines significantly. Organizations worry about ROI before committing to major integration investments. Retrofitting older systems takes months and costs substantial capital.

Solutions

- Partner with AI integration services specialists experienced in enterprise system integration across your industry

- Use middleware solutions bridging legacy systems to modern platforms without complete replacement

- Start with pilot projects validating the integration approach before full-scale deployment across the organization

- Plan for phased rollout rather than big-bang implementation to manage risk and validate approach

5. Regulatory compliance and explainability

The regulatory landscape evolves rapidly. Multiple regulations expand constantly, requiring explainability and audit trails. Liability questions remain unresolved when AI decisions cause harm. High-risk applications require validation evidence before deployment. Organizations must navigate complex and changing requirements.

Solutions

- Start with use cases having regulatory clarity, like administrative automation and documentation support, with clearer pathways

- Maintain detailed audit trails of all AI recommendations and human decisions for regulatory review and defense

- Implement explainable AI methodologies to provide transparency into decision processes and enable regulatory compliance

- Conduct rigorous validation testing before deployment; engage legal counsel specializing in AI regulation

6. Privacy and security concerns

AI systems handle massive volumes of sensitive data, including patient records and financial information. Data breaches expose both training data and user privacy simultaneously. Models can memorize individual records if not carefully designed. Re-identification risks persist even with “anonymized” data through sophisticated techniques.

Solutions

- Implement differential privacy techniques, preventing individual record extraction from trained models

- Use federated learning, where models train locally without centralizing sensitive data on shared servers

- Encrypt data in transit and at rest; implement role-based access controls and audit trails

- Conduct regular security audits and penetration testing; use privacy-preserving techniques like homomorphic encryption

To tackle these challenges more effectively, following the best practices when implementing AI in risk management is crucial. So, let’s take a quick look at some tips to follow for a successful implementation.

Tips for Successful Implementation of AI-Driven Risk Management

Deploying artificial intelligence in risk management requires more than buying software. Success depends on strategic planning, organizational alignment, and pragmatic execution that balances ambitious goals with operational reality.

1. Start with high-impact, low-complexity use cases

Building an AI risk management framework works best when you begin with risks that cost the most or create the greatest disruption. These deliver visible ROI quickly, building organizational confidence and justifying larger investments. Start with use cases you can implement within 3-6 months rather than ambitious, multiyear transformations.

Action items

- Map your riskiest operational areas where failures create the biggest impact

- Prioritize use cases with existing clean, accessible data

- Choose areas where results become visible within 3-6 months

Many organizations partner with AI consulting services during this initial phase to identify the highest-ROI use cases, assess data readiness, and create realistic implementation roadmaps that balance ambition with operational constraints.

2. Build cross-functional implementation teams

How can artificial intelligence and risk management work together effectively? Through teams combining risk expertise, technical capability, and business authority. Developing an AI risk management framework requires risk managers who understand what to measure, IT professionals who understand technical requirements, and business leaders who understand feasibility and constraints.

Action items

- Assemble teams with risk, IT, finance, compliance, and operations representation

- Include a business sponsor empowered to make decisions and remove obstacles

- Establish clear accountability for each team member’s domain

- Engage experienced AI consultants who can bridge the gap between technical capabilities and business requirements

3. Invest heavily in data quality upfront

AI models learn from data. Garbage data produces garbage predictions. Most implementation failures trace back to poor data quality, not inadequate AI technology. Plan for data cleaning and standardization, consuming 20–30% of your project timeline.

Action items

- Audit existing data for completeness, accuracy, and consistency

- Establish data governance standards before development begins

- Identify and fix data quality issues before feeding them to AI systems

4. Establish clear governance and accountability

Artificial intelligence and risk management systems operate continuously. Without clear governance, accountability disappears. Models degrade, performance drifts, and organizations lose confidence in AI recommendations. A comprehensive AI risk management framework includes explicit governance structures defining who owns what and when AI recommends versus decides.

Action items

- Define who owns model performance monitoring and retraining

- Create escalation procedures for unexpected AI outputs

- Establish review cadences: weekly or monthly performance checks

- Document when AI recommends versus when AI decides

5. Plan deliberate change management and user adoption

Risk managers often distrust automated systems. If implementation feels threatening or doesn’t address real workflow problems, adoption fails regardless of AI quality. Involve end users in design before building systems they’ll inherit.

Action items

- Demonstrate how AI eliminates tedious work, freeing time for strategic thinking

- Provide comprehensive training tailored to different user roles

- Create internal champions who evangelize adoption within their departments

- Celebrate early wins publicly to build confidence

6. Choose the right implementation partner

Building AI risk management systems requires specific expertise: risk domain knowledge, data engineering, model development, and regulatory compliance understanding. Few internal teams possess all these capabilities. Evaluate partners on both technical capability and domain experience.

Action items

- Request detailed case studies from similar implementations in your industry

- Prioritize partners who transfer knowledge to your team, not create dependency

- Verify partnerships with cloud providers (AWS, Azure, GCP)

- Include contractual performance guarantees and support commitments

- Hire AI developers with proven expertise in risk management systems who can build, deploy, and optimize models specific to your industry requirements

These six implementation principles significantly increase success probability. Organizations that follow them systematically report substantially higher adoption rates and faster ROI realization.

Partner with Space-O AI to Enable AI in Your Risk Management Strategy

Artificial intelligence fundamentally reshapes how organizations manage risk. From detecting fraud patterns in milliseconds to predicting equipment failures before they occur, AI delivers capabilities that traditional approaches cannot match. Organizations implementing artificial intelligence in risk management today gain competitive advantages that persist for years.

Backed by 15+ years of AI engineering experience and 500+ successful AI projects, we help organizations build secure, scalable AI risk management solutions. Whether you need fraud detection, compliance automation, or predictive maintenance frameworks, our 80+ certified specialists deliver precision, quality, and compliance alignment always.

At Space-O AI, we combine deep technical knowledge with strategic business insight to turn your vision into a practical, high-performing reality. We handle the complete journey from strategy assessment through implementation and optimization, ensuring your organization benefits from AI capabilities without technical complexity.

Check our portfolio to see how we’ve helped global organizations transform operations through intelligent AI systems.

AI Recruiting Software

An AI-powered web application built by Space-O automates candidate screening using generative AI. The platform generates role-specific questions, converts video responses to text, and scores candidates against reference answers. Delivered in 2.5 months, it enables recruiters to screen hundreds of candidates simultaneously while reducing manual evaluation time significantly.

AI Receptionist (Welco)

Space-O Technologies developed Welco, a SaaS platform that automates front desk operations using conversational AI and speech recognition. The system handles 24/7 call answering, appointment scheduling, and multilingual customer support. Welco reduced the client’s missed inquiries by 67% while delivering consistent service outside business hours without requiring additional staff.

WhatsApp AI Chatbot for Roofing Company

Retrieving business analytics instantly, the WhatsApp chatbot created by Space-O uses GPT-3.5 to fetch data from roofing management software. Employees access sales data, project metrics, and financial information via WhatsApp. Developed in five days, it eliminates hours of manual data compilation for critical business insights.

If you are ready to bring responsible, high-impact AI into your risk management ecosystem, Space-O AI has the experience, technology, and expertise to make it happen. Schedule a free consultation with our AI risk management experts today!

Frequently Asked Questions About AI in Risk Management

1. How does AI in risk management differ from traditional risk management?

Traditional risk management relies on manual analysis, historical data, and human judgment. Teams examine data periodically during scheduled reviews. AI risk management operates continuously, analyzing vast data volumes instantly, identifying patterns humans would miss, and predicting risks before they materialize. Traditional approaches are reactive. AI approaches are proactive.

2. What’s the typical timeline for AI risk management implementation?

Initial assessment takes 2–4 weeks, followed by pilot deployment spanning 8–16 weeks. Full implementation typically requires 4–6 months for straightforward use cases and 6–12 months for complex implementations requiring substantial data integration. Most organizations achieve positive ROI within 12–18 months, with quick-win use cases showing returns in 3–9 months.

3. How does AI handle bias and fairness in risk management?

Bias in AI systems emerges when training data reflects historical biases or when data underrepresents certain populations. Address bias through diverse training data, regular testing across demographic groups, explainable AI methodologies providing transparency, and ongoing bias audits. Implement testing protocols validating that AI doesn’t discriminate.

4. What skills do we need internally to manage AI risk management systems?

Organizations need data engineers managing data pipelines, AI specialists for model governance, risk domain experts validating outputs, and compliance professionals ensuring regulatory alignment. You don’t need to build everything internally. Many organizations combine internal teams with external partners providing specialized expertise.

5. How do we handle regulatory compliance with AI risk management?

Start with regulatory-clear applications where expectations are established. Engage regulators early through pre-submission meetings, discussing your approach. Implement rigorous validation and testing before deployment. Maintain detailed audit trails documenting AI recommendations and decisions. Work with legal counsel specializing in AI regulation for your industry.

6. Can smaller organizations implement AI risk management?

Yes. Start with focused use cases rather than enterprise-wide transformation. Use cloud-based solutions rather than building infrastructure. Consider managed services, which spread costs over time rather than requiring a large upfront investment. Many organizations begin with single use cases demonstrating value before expanding scope.

Build AI for Smarter Risk Decisions

What to read next